AI personalization algorithms transform commercial real estate (CRE) investment by leveraging machine learning to analyze vast datasets. These tools unlock hidden market insights and tenant behaviors, enabling returning investors to make data-driven decisions with enhanced accuracy. By considering individual risk profiles and histories, algorithms provide tailored investment strategies, maximizing returns while minimizing exposure to unforeseen market dynamics.

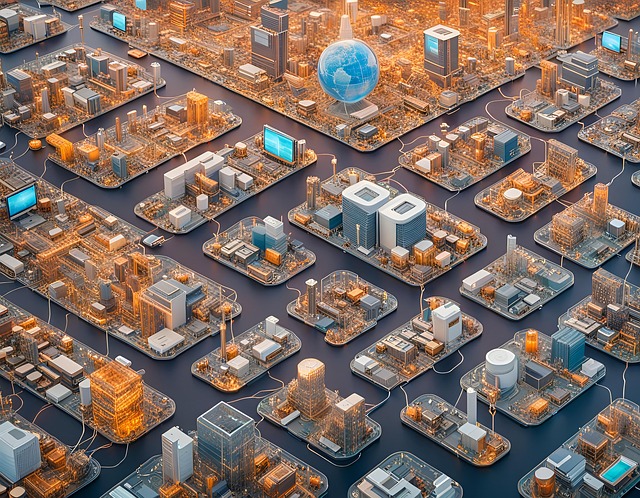

In the dynamic landscape of commercial real estate (CRE), Artificial Intelligence (AI) is transforming investment strategies with its data-driven insights and personalized models. This article explores how AI revolutionizes CRE investment risk modeling, particularly focusing on algorithmic approaches tailored for returning investors. Unlocking hidden patterns in vast datasets, AI personalization algorithms enable informed decisions, enhancing portfolio management and risk mitigation. By leveraging these innovative tools, investors can navigate the complex CRE market with greater confidence and precision.

- Unlocking Insights: AI's Role in Data-Driven Investments

- Personalized Models: Tailoring Strategies for Returning Investors

- Mitigating Risks: Algorithmic Approaches to Commercial Real Estate

Unlocking Insights: AI's Role in Data-Driven Investments

AI is transforming commercial real estate investment by unlocking valuable insights that were previously hidden in vast data sets. Through advanced machine learning and personalization algorithms, AI can analyze market trends, tenant behavior, and property performance like never before. This allows returning investors to make more informed decisions, identifying lucrative opportunities and mitigating risks with unparalleled accuracy.

By leveraging AI’s ability to process complex data, investors gain a competitive edge in a dynamic market. Personalization algorithms tailored for returning investors consider their unique risk profiles and investment histories, providing customized recommendations that align with their goals. This level of insight enables more strategic allocation of capital, maximizing returns while minimizing exposure to unforeseen factors.

Personalized Models: Tailoring Strategies for Returning Investors

Returning investors in commercial real estate (CRE) often face unique challenges and goals compared to first-time buyers. To address this, AI offers a powerful tool for personalized risk modeling. Algorithms can analyze historical data, investment patterns, and market trends specific to individual investors, creating tailored strategies that align with their risk tolerance, investment preferences, and past performance. This level of personalization ensures that investment recommendations are not one-size-fits-all but instead cater to the specific needs and experiences of returning investors.

AI personalization algorithms can identify subtle patterns in an investor’s success and failure points, enabling them to suggest optimal CRE opportunities. By learning from each investor’s historical decisions, these models evolve over time, providing more accurate insights. This dynamic approach allows for continuous refinement of investment strategies, ensuring that returning investors stay competitive in the ever-evolving CRE market while mitigating risks associated with their specific investment behaviors.

Mitigating Risks: Algorithmic Approaches to Commercial Real Estate

In the realm of commercial real estate (CRE) investment, mitigating risks is paramount for both new and seasoned investors alike. Algorithmic approaches powered by artificial intelligence (AI) are revolutionizing risk modeling in this sector, offering unprecedented precision and personalization. AI personalization algorithms can analyze vast datasets to tailor investment strategies for returning investors, factoring in market trends, property performance, and unique investor preferences.

These advanced models can uncover subtle patterns and correlations that traditional methods might miss, enabling investors to make more informed decisions. By leveraging machine learning and predictive analytics, the algorithms can forecast potential risks—such as vacancy rates or rental price fluctuations—and suggest optimal investment allocations. This proactive risk management not only protects investments but also amplifies returns over time, making AI an invaluable tool for navigating the complex CRE market.

Artificial Intelligence (AI) is transforming commercial real estate investment, offering both opportunities and challenges. By leveraging AI personalization algorithms, developers can create tailored models for returning investors, enhancing risk mitigation strategies. This data-driven approach allows for more informed decisions, optimizing portfolio management and maximizing returns. As AI continues to evolve, its role in shaping the future of CRE investment is undeniable, promising a smarter and safer investment landscape for all stakeholders.